What is Payment Gateway?

Here are a few reliable payment gateway you can work with.

- Ozow – Instant EFT

- PayFast – Instant EFT, Local & International Debit & Credit Cards, Masterpass, Mobicred, Zapper, Scode & Subscriptions Payments – Debit Orders

- Paystack- Transfers, Instant EFT, Local & International Debit & Credit Cards, SnapScan, Apple Pay, Masterpass, USSD

- Yoco – Local & International Debit & Credit Cards

- PayU – Instant EFT, Local Debit Cards

- Netcash – Bulk or Salary Payments, Debit Orders

- SnapScan – QR

- Pay Genius – Instant EFT, Local & International Debit & Credit Cards

- Peach Payments – Instant EFT, Debit & Credit Cards, Masterpass, ApplePay, Mobicred.

- SiD Payment – Instant EFT

- MoneyMatrix – Crypto

The payment gateway in an e-commerce store should be set up in the right manner, if it’s not properly functional, your business could suffer from cart abandonment due to payment gateway issues, that leads to loss of customer and sales. Ensuring a functional payment gateway set up with multiple forms of payment options (debit, credit cards, wallets, etc.) with trusted security certificates and symbols is the key for long term success.

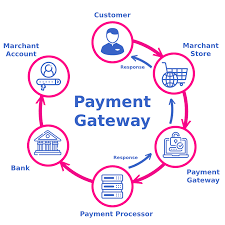

How does a payment gateway work?

The customer adds products or services to the cart that they want to buy and proceed with the payment page.

The customer is then asked to provide the details of the credit card or debit card. These details include 16 digit card number, cardholder name, expiration date and CVV number.

After submitting, the information is securely passed on to your payment gateway, based on the integration type i,e. Server-to-server, payment page integration or client-side encryption.

The payment gateway then encrypts the card details and goes through a security check before sending the card information to the acquiring bank.

The acquiring bank sends the information securely to the card schemes i,e. Visa, Mastercard, Amex, Maestro card, etc.

The card schemes ensure another layer of security check and then send the payment information to the issuing bank. After performing the security and fraud check, the issuing bank authorises the transaction. The approval or decline message is sent back to the bank from the card schemes, then to the acquirer.

The acquiring bank then sends the approval or decline message to the payment gateway who then sends the message to the merchant. If the payment is successful then the acquirer collects the payment amount from the issuing bank and holds the funds in the merchant account. Based on the message from the payment gateway, the merchant may either display the order or payment confirmation page or ask the customer to retry with other payment methods. The best payment gateway provides smooth transactions and the process happens in the background in real-time and the whole procedure takes less than three seconds to complete.

What to consider when choosing a payment gateway?

Choosing the best payment gateway provider for your eCommerce website is a tedious process. While choosing, you should ensure that customer payment experience is smooth, fast and secure. This helps to increase the trust among the customers and come back to purchase other products or services in future.

Here are four factors to consider before selecting the payment gateway:

2. Ease of website integration.

Make sure that the payment gateway integration is simple and also check whether the customer support is good. If we face any issues it should be easily and quickly resolved without hassle with the help of the customer support team.

3. Payout time;

The best payment gateway service providers have a reasonable timeframe for the payouts. Check the payout time frames before integration. The average payout could be weekly or bi-weekly, and also varies from company to company.

4. Multi-currency;

If your business is global, then make sure your payment gateway providers support multi-currency payments, as people around the world use different currencies, you should be ready to accept different currencies with ease.

We hope you find the gateway list helpful?

Let us know in the comment section below If you have or know other payment gateways so we can list them among the list

Please subscribe to our YouTube Channel for exchange video tutorials. You can also find us on Twitter and Facebook.